FaceTime Like a Pro

Get our exclusive Ultimate FaceTime Guide 📚 — absolutely FREE when you sign up for our newsletter below.

FaceTime Like a Pro

Get our exclusive Ultimate FaceTime Guide 📚 — absolutely FREE when you sign up for our newsletter below.

Turn your iPhone into a smarter wallet. Activate Apple Card and start paying, tracking, and earning Daily Cash with ease.

Apple Card is a credit card designed for people who live on their iPhone. Instead of confusing fees and complicated rewards, this card offers a simple way to pay, track, and manage your money. If you already use the Wallet app on your iPhone, Apple Card feels like a built-in digital bank.

In this guide, you’ll learn how to activate and use Apple Card in 2026, from applying and setting it up to making payments, managing your card, and fixing common issues. Whether you’re new to Apple Card or just want to use it more effectively, this article walks you through everything step by step.

Apple Card, issued by Goldman Sachs and running on the Mastercard network, works like a standard credit card but lives inside the Wallet app. You can:

Every transaction appears instantly in Wallet and is categorized automatically, such as food, shopping, or travel. Apple Card is ideal for users who want an easy-to-use credit card with clear spending insights and no hidden fees.

If you are deeply invested in the Apple ecosystem, Apple Card fits right in.

Apple Card keeps fees simple:

There are also no returned payment, maintenance, or setup fees. This makes Apple Card one of the most beginner-friendly and affordable credit cards available.

However, interest applies if you carry a balance past the grace period. The APR typically ranges from 17.74% to 27.99%, depending on your credit profile. Apple clearly shows how much interest you will pay if you do not pay the balance in full, which helps you make better decisions and save money over time.

Apple Card stands out in several important ways compared to traditional credit cards:

Everything from applying to paying your bill happens on your iPhone, making it easier to maintain healthy financial habits. According to Apple, this credit card works for you, not against you.

Before applying, make sure you have:

Apple Card is currently available only in the United States.

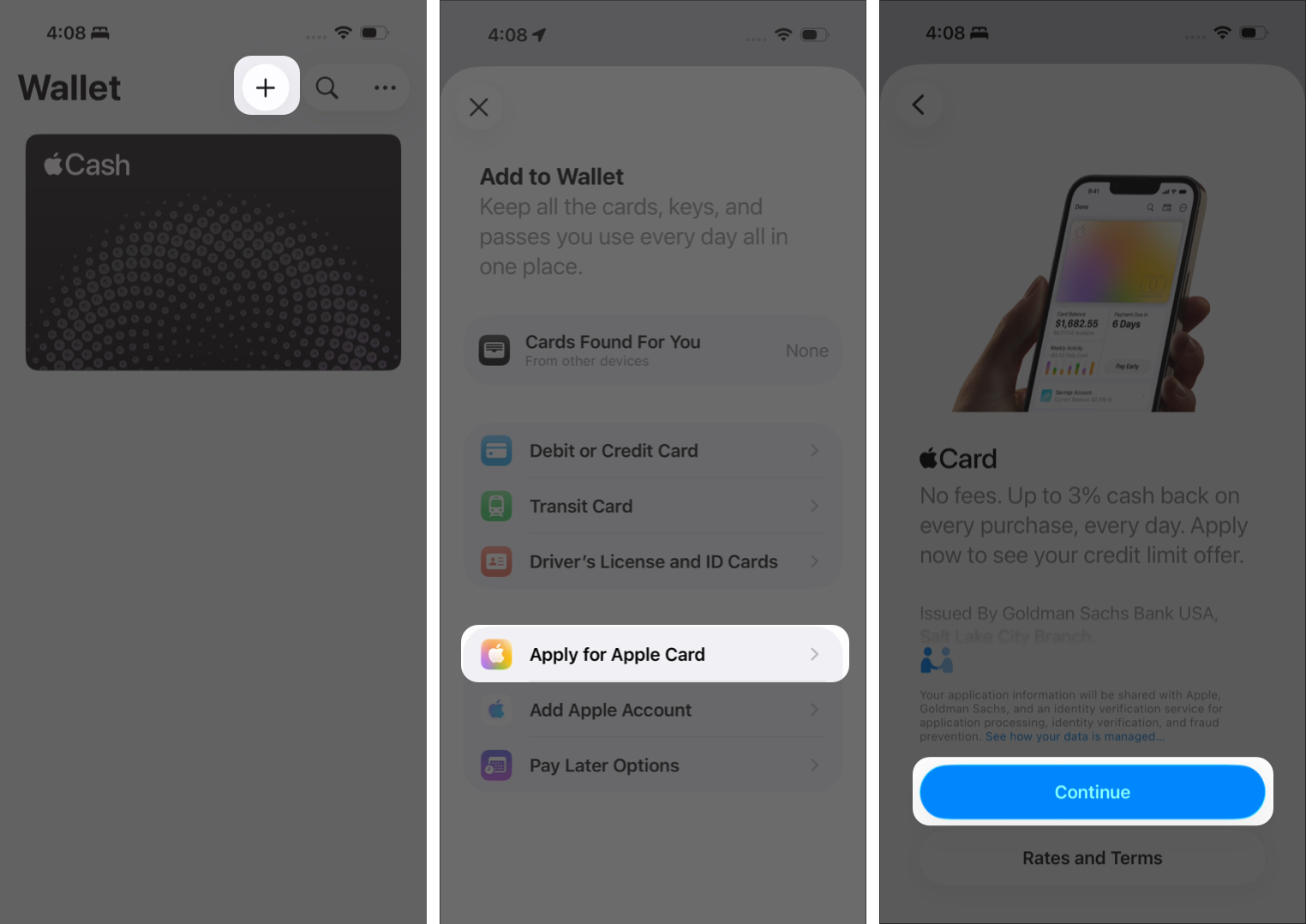

Applying takes just a few minutes:

Approval is usually instant, and there is no impact if your application is denied. Apple suggests a minimum FICO score of around 660 to improve your chances of approval.

After your digital Apple Card is approved, you can request the physical titanium card. Here’s how:

The titanium card is mailed to the billing address saved in Wallet. It usually arrives within one to two weeks, and you will receive a notification when it ships.

Your digital Apple Card is automatically activated once you are approved. You can start using it immediately with Apple Pay. The physical titanium card requires activation.

You will need a compatible iPhone running the latest version of iOS.

When your titanium card arrives:

Your card will be ready to use right away.

You can still activate your card:

Follow the on-screen steps, and your card will be activated within minutes.

You can use Apple Card:

Apple Card works in the U.S. and internationally, with no foreign transaction fees. You can also add family members to share the same credit line using Apple Card Family.

That’s it. It is fast and secure. You can also use installment payments where available and set up AutoPay for convenience.

If a store or website does not accept Apple Pay, you can manually enter your virtual card number, expiration date, and security code.

Apple makes card management simple. You can view transactions, check your balance, and track spending directly in the Wallet app. There is no need to log in to another app or website.

You can view your card number, expiration date, and CVV. You can also request a new card number or lock your titanium card if your card information is compromised.

Open Apple Card in Wallet and scroll to see recent transactions. To view detailed spending:

You will see color-coded categories, spending summaries, and even maps showing where purchases were made. You can also search transactions by date, amount, merchant, category, or location.

This is useful for records or expense tracking.

Here are the most common Apple Card errors you may face.

Try the following:

Possible reasons include:

Review transaction details in Wallet or contact support if needed.

Immediately follow these steps if your card is misplaced:

You can request a replacement card directly from the app.

Small habits can make a big difference.

If you already use Apple Pay and want a simple, no-fee credit card with a great user experience, Apple Card is still a solid choice in 2026. It makes credit feel more transparent and less stressful. Used wisely, it can be a reliable part of your everyday spending.

What do you think about Apple Card? Let us know in the comments below.

FAQs

Yes. There is no cost to request or use the titanium card.

Yes. Apple Card offers 2 percent Daily Cash on eligible purchases, credited directly to your Apple Cash card or Savings account.

No. An iPhone is required to apply for, activate, and manage Apple Card.